- Chandigarh UT

- Creative Corner

- Dadra Nagar Haveli UT

- Daman and Diu U.T.

- Department of Administrative Reforms and Public Grievances

- Department of Biotechnology

- Department of Commerce

- Department of Consumer Affairs

- Department of Industrial Policy and Promotion (DIPP)

- Department of Posts

- Department of Science and Technology

- Department of Telecom

- Digital India

- Economic Affairs

- Ek Bharat Shreshtha Bharat

- Energy Conservation

- Expenditure Management Commission

- Food Security

- Gandhi@150

- Girl Child Education

- Government Advertisements

- Green India

- Incredible India!

- India Textiles

- Indian Railways

- Indian Space Research Organisation - ISRO

- Job Creation

- LiFE-21 Day Challenge

- Mann Ki Baat

- Manual Scavenging-Free India

- Ministry for Development of North Eastern Region

- Ministry of Agriculture and Farmers Welfare

- Ministry of Chemicals and Fertilizers

- Ministry of Civil Aviation

- Ministry of Coal

- Ministry of Corporate Affairs

- Ministry of Culture

- Ministry of Defence

- Ministry of Earth Sciences

- Ministry of Education

- Ministry of Electronics and Information Technology

- Ministry of Environment, Forest and Climate Change

- Ministry of External Affairs

- Ministry of Finance

- Ministry of Health and Family Welfare

- Ministry of Home Affairs

- Ministry of Housing and Urban Affairs

- Ministry of Information and Broadcasting

- Ministry of Jal Shakti

- Ministry of Law and Justice

- Ministry of Micro, Small and Medium Enterprises (MSME)

- Ministry of Petroleum and Natural Gas

- Ministry of Power

- Ministry of Social Justice and Empowerment

- Ministry of Statistics and Programme Implementation

- Ministry of Steel

- Ministry of Women and Child Development

- MyGov Move - Volunteer

- New Education Policy

- New India Championship

- NITI Aayog

- NRIs for India’s Growth

- Open Forum

- PM Live Events

- Revenue and GST

- Rural Development

- Saansad Adarsh Gram Yojana

- Sakriya Panchayat

- Skill Development

- Smart Cities

- Sporty India

- Swachh Bharat (Clean India)

- Tribal Development

- Watershed Management

- Youth for Nation-Building

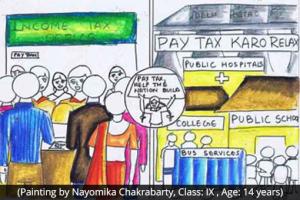

Inviting innovative ideas and suggestions on tax policy and administration

Start Date :

Sep 18, 2015

Last Date :

Mar 01, 2016

00:00 AM IST (GMT +5.30 Hrs)

One of the key priorities of the Government is to provide a non-adversarial and a responsive tax administration with the main objective of creating an environment conducive for ...

All Comments

New Comments

Showing 1495 Submission(s)

Gaurav Chugh_3

10 years 2 months ago

As we all know that India's total population is 128 billion and only about 3% of Indian population pay Income tax, which comes to 35 million tax payers. In that too majority of the tax payers fall under 2.5 - 5 Lakhs slab. i feel that the people take undue advantage of the rebates under certain exemptions. example:- the rich farmers, business owners & self employed professionals.

If we can some how increase the % of people paying the tax, we can fulfill the objective of ease of doing business.

Like

(1)

Dislike

(0)

Reply

Report Spam

Manish Garg_6

10 years 2 months ago

The cost of education in a primary school is a single biggest source of expense for many families. These schools provide good education and have filled a gap where the state has failed. Though most of these schools are registered as charitable organization and are exempted from taxes, however these schools function like a commercial organization. The request is to provide the relief to parents by making school fee as tax deductible and withdrawing tax exemption from these institutes.

Like

(0)

Dislike

(0)

Reply

Report Spam

Manish Garg_6

10 years 2 months ago

There is a requirement of filing return even if we don’t have taxable income e.g. owning a house, credit card expenditure of 2 lakhs etc. My mother owns a house and she has to file a return just for compliance. If the purpose is tax evasion, we should review these conditions and make it capture spending of riches. Maybe we can ask a person to file a return if s/he buys or sells a property in a year and not if s/he owns the house.

Like

(0)

Dislike

(0)

Reply

Report Spam

Manish Garg_6

10 years 2 months ago

Please abolish 80C exemptions and raise the income tax exemption limit by 1.5 lakhs. This will free large number of people from filing tax return. This will also bring down the workload on tax infrastructure and tax officials. The government will get more revenue as effective tax rate for tax payer in higher bracket will go up. I feel we have been following a wrong policy of widening tax base by keeping low exemption limit and providing various types of exemptions. We need to simplify it.

Like

(0)

Dislike

(0)

Reply

Report Spam

SAURABH AGARWAL_5

10 years 2 months ago

AS REGARDS THE NPS SCHEME THE TAXATION AT THE TIME OF MATURITY IS UNCERTAIN AND IF THE SAME CAN BE EXEMPT FROM TAX AT MATURITY, THE SAME WILL REALLY BE A BOON FOR THE RETIRING PERSONNEL AND ALSO BOOST INVESTMENT IN THE SAME

Like

(0)

Dislike

(0)

Reply

Report Spam

SAURABH AGARWAL_5

10 years 2 months ago

MY PROBLEM IS REGARDING THE TAXATION ON PURCHASE OF PROPERTY WHEREIN WEST BENGAL , THE GOVERNMENT CIRCLE RATE IS MORE THAN THE MARKET RATE BY A VERY GOOD PERCENTAGE WHICH CAUSES THE DIFFERENCE OF THE TWO TO BE ADDED AS NOTIONAL INCOME TO THE INCOME OF THE PURCHASER AND TAXED ACCORDINGLY. THIS IS CAUSING A VERY GRAVE PROBLEM FOR THE GENERAL PEOPLE WHO HAVE TO FIRST SHELL OUT HIGHER REGISTRY CHARGES BECAUSE OF THE SAME AND SUBSEQUENTLY ALSO BEING TAXED ON NOTIONAL GAIN.

THIS REQUIRES CHANGES

Like

(0)

Dislike

(0)

Reply

Report Spam

hanumant d bhikoji

10 years 2 months ago

good to see the step...

Like

(0)

Dislike

(0)

Reply

Report Spam

Arghya_4

10 years 2 months ago

In India the support system for older citizen is extremely poor. In many situation they are left to their destiny for those who are not covered under pension scheme. The situation becomes more painful in case they have single child and that too a girl child. I have a suggestion that for such category of people the tax shall be completely expected so that they can have a quality life after their earning period (60yrs) is over as the parents with girl child has no opportunity to ask for help

Like

(0)

Dislike

(0)

Reply

Report Spam

kamal manocha

10 years 2 months ago

Reschedule the retirement age

I may like to inform you to increase employment the retirement age should be reduced and be fixed 58 years.

It will cause many oppositions so to avoid this,initially it should be made 59 years and six months and after every year 6 months should be reduced.

With the increased age, working capacity is reduced especially for Govt. Employees . Secondlly chances Jobs for youth,resulting better results for good Goverenace.

Like

(0)

Dislike

(0)

Reply

Report Spam

Prajapati Gautam Kishorbhai

10 years 2 months ago

Agar humme tax 4% se lekar 10% krna hai to sudse phele Hume water used or water waste pe dhayan rakhna hoga.islye Hume ghar gharpe water meter lagane padege jisse Hume patta chlegaki kon kitana water used krta hai..ise Hume bill through tax milega jise humara tax 6% ya 7% badha jayega or water waste pe charge milega WO bhai alagse...Jay Hind...

Like

(0)

Dislike

(0)

Reply

Report Spam

- View More