- Chandigarh UT

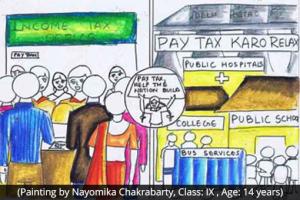

- Creative Corner

- Dadra Nagar Haveli UT

- Daman and Diu U.T.

- Department of Administrative Reforms and Public Grievances

- Department of Biotechnology

- Department of Commerce

- Department of Consumer Affairs

- Department of Industrial Policy and Promotion (DIPP)

- Department of Posts

- Department of Science and Technology

- Department of Telecom

- Digital India

- Economic Affairs

- Ek Bharat Shreshtha Bharat

- Energy Conservation

- Expenditure Management Commission

- Food Security

- Gandhi@150

- Girl Child Education

- Government Advertisements

- Green India

- Incredible India!

- India Textiles

- Indian Railways

- Indian Space Research Organisation - ISRO

- Job Creation

- LiFE-21 Day Challenge

- Mann Ki Baat

- Manual Scavenging-Free India

- Ministry for Development of North Eastern Region

- Ministry of Agriculture and Farmers Welfare

- Ministry of Chemicals and Fertilizers

- Ministry of Civil Aviation

- Ministry of Coal

- Ministry of Corporate Affairs

- Ministry of Culture

- Ministry of Defence

- Ministry of Earth Sciences

- Ministry of Education

- Ministry of Electronics and Information Technology

- Ministry of Environment, Forest and Climate Change

- Ministry of External Affairs

- Ministry of Finance

- Ministry of Health and Family Welfare

- Ministry of Home Affairs

- Ministry of Housing and Urban Affairs

- Ministry of Information and Broadcasting

- Ministry of Jal Shakti

- Ministry of Law and Justice

- Ministry of Micro, Small and Medium Enterprises (MSME)

- Ministry of Petroleum and Natural Gas

- Ministry of Power

- Ministry of Social Justice and Empowerment

- Ministry of Statistics and Programme Implementation

- Ministry of Steel

- Ministry of Women and Child Development

- MyGov Move - Volunteer

- New Education Policy

- New India Championship

- NITI Aayog

- NRIs for India’s Growth

- Open Forum

- PM Live Events

- Revenue and GST

- Rural Development

- Saansad Adarsh Gram Yojana

- Sakriya Panchayat

- Skill Development

- Smart Cities

- Sporty India

- Swachh Bharat (Clean India)

- Tribal Development

- Watershed Management

- Youth for Nation-Building

Inviting innovative ideas and suggestions on tax policy and administration

Start Date :

Sep 18, 2015

Last Date :

Mar 01, 2016

00:00 AM IST (GMT +5.30 Hrs)

One of the key priorities of the Government is to provide a non-adversarial and a responsive tax administration with the main objective of creating an environment conducive for ...

All Comments

New Comments

Showing 1495 Submission(s)

Goldwin James_1

9 years 11 months ago

term capital gains shall be reduced by the amount by which the total income as so reduced falls short of the maximum amount which is not chargeable to income-tax and the tax on the balance of such short-term capital gains shall be computed at the rate of fifteen per cent"---------i still not understand what it syas

Like

(0)

Dislike

(0)

Reply

Report Spam

Goldwin James_1

9 years 11 months ago

the rules and regulations in Income Tax act need to be in simple or should provide a hand book with examples. Suppose the line in Sec 111 A reads where the total income as reduced by such short-term capital gains is below the maximum amount which is not chargeable to income-tax, then, such short-term capital gains shall be reduced by the amount by which the total income as so reduced falls short of the maximum amount which is not chargeable to income-tax and the tax on the balance of such short-

Like

(0)

Dislike

(0)

Reply

Report Spam

AMIT KUMAR_886

9 years 11 months ago

In case of default made by companies for TDS the company should be summoned not the individuals. But currently all the individuals are harassed by income tax department by giving notices repeatedly despite knowing that the company is defaulter not the individual so that the individual get pressurized and start doing compromise i.e gave any kind of bribe. This is purely increasing the corruption nothing else. Even Supreme court of India has given several decisions that the companies are Responsi

Like

(1)

Dislike

(0)

Reply

Report Spam

AMIT KUMAR_886

9 years 11 months ago

These are the two major thing is included in tax policy tax fraud and unnecessary govt expense on tax recovery shall be avoided completely.

1) The Govt Employees should be given tax free salary as per the Tax slab in which they are falling.By doing the calculation which has no loss to govt and individual. Everyone will support this.

2. By transferring the TDS deduction power from Private companies to Bank. and the Companies will only be responsible for calculation of tax & give docs to bank.

Like

(1)

Dislike

(0)

Reply

Report Spam

AMIT KUMAR_886

9 years 11 months ago

The private companies has to pay the full salary to banks and the bank should deduct the tax and submitted to income tax department. The account officers/DDO of private companies should only do all the calculations and tax exemption formalities i.e. HRA / Insurance/ TPT/ CEA and other allowance as exempted by Income tax department and submit to bank with nominal roll and bank should cut the income tax as per the tax sheet provided by the company. But the company should give all the salary toBank

Like

(1)

Dislike

(0)

Reply

Report Spam

AMIT KUMAR_886

9 years 11 months ago

There are several examples of TDS frauds like Kingfisher Airlines being the recent defaulter who had done tax default of 466 crores and still enjoying the levis life but not paying any money to income tax department and few of the officers are detailed only to visit court for the recovery from these types of defaulters. This is clearly a wastage of govt. money and manpower . This manpower can be used at some creative work for for building of nation.

Like

(1)

Dislike

(0)

Reply

Report Spam

AMIT KUMAR_886

9 years 11 months ago

Secondly the power of cutting tax should be given to Banks the CA of private firms will give the documents of tax calculation of individual to bank and the bank will cut the TDS and deposit the amount to income tax office . It will STOP TDS scams done by most of the private companies. They cuts the TDS and never deposits to income tax offices and IT Dept can only file case against them but cannot recover any single Rs. And individuals are harassed by Notices of income tax dept without any fault

Like

(1)

Dislike

(0)

Reply

Report Spam

AMIT KUMAR_886

9 years 11 months ago

This is the time to change the tax policy for the government employees as this is duplicacy of work. The policy go giving salary and than deducting tax may be scraped and should be Tax Free salary by fixing the salary as per tax slabs. This will relieve the Income Tax offices from over burden and they can concentrate on catching the defaulters for tax payment.All DA/ Increment can be fixed as per tax slabs without any loss to employee and government. Please think on this.

Like

(1)

Dislike

(0)

Reply

Report Spam

Venkatraman_4

9 years 11 months ago

For Nations progress, please stop giving money to the people who commit suicide or who met accidents. Let them get insured. Increase the insurance amount in all tickets so as they pay for the same. In case of accident or death, then they should be given some relief. Do not encourage people in the name of caste, creed, that they are dalit, sc so they will get money or government job in lieu of death of a person from a community, caste.This has become a regular practice and our tax money is wasted

Like

(1)

Dislike

(0)

Reply

Report Spam

AMIT KUMAR_886

9 years 11 months ago

For the progress of nation please implement income tax free salary to government employees by calculating the salaries and increment as per tax slabs without any loss to government and government employees. It will give a huge no of manpower time spare for monitoring of tax defaulters.

Like

(0)

Dislike

(0)

Reply

Report Spam

- View More